Yatta Checkout User Guide

Taxation

Depending on where your company is based, and which country the buyer comes from, different taxation rules apply. If you are located and taxed within the EU, please consult the official EU guide for more information.

Verification of the user’s VAT number and VAT calculation is handled automatically by Yatta Checkout.

Note: While we do everything we can to streamline the process for you, VAT payment remains the vendor’s responsibility. We therefore cannot assume liability for the correctness of your VAT calculation.

Invoicing

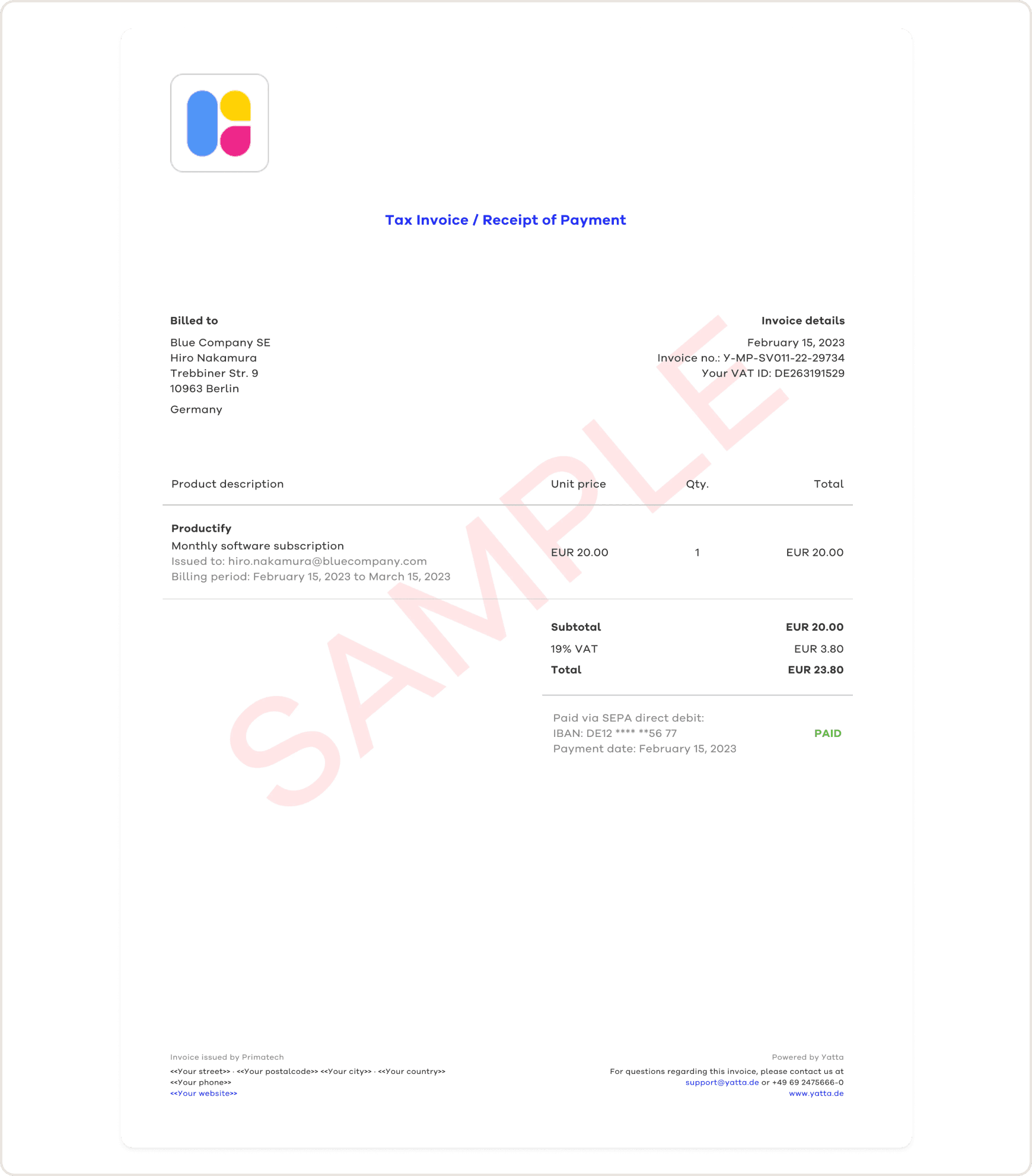

Generally, invoices are sent in PDF format to the user’s primary email address after each successful transaction. If a different billing email address is provided in the billing address form, the invoice is only sent to the billing email address. An overview of all current and past invoices is provided in the user account (IAM).

Legal requirements

The sent invoices include legally required information about the company issuing the invoice (i.e., you), the recipient and the transaction. In addition, invoices include your logo and contact information. Please note, however, that we cannot assume liability for the correctness of the VAT calculation shown on the invoice.

Invoice numbering scheme

Invoice numbers are generated in a way that complies with official accounting standards. Each invoice is given a unique invoice number and the invoices are numbered sequentially.

Example invoice numbering scheme for a Vendor (“Software Vendor”) with the tag

| Y-MP-TAG-YY-##### | Y-MP is static, followed by the Vendor Tag and the last 2 digits of the current year. The last part is a five-digit number that increases with each invoice generated. |

| Y-MP-SV011-22-00001 | The first invoice of SV via the Yatta Checkout in 2022. |

| Y-MP-SV011-23-01337 | The 1337th invoice of SV via the Yatta Checkout in 2023. |