Our highlights from Collision 2024

Latest conference news from North America about AI, startups and venture capital trends.

Published

Published

The Collision conference has come a long way since it started in 2009. Back then, it was a smaller affair, with 1,500 attendees traveling to Las Vegas. It grew consistently over the years, moving to New Orleans for a stint before leaving the US and setting up shop in Toronto, Canada in 2019—when over 25,000 gathered for the event. Now, five years and a pandemic later, the conference is in its final year in Toronto and brought more than 40,000 people to the city from around the world.

This year, with over 800 sessions on offer, the speaker list was appropriately brimming with expertise and interesting topics. Some of our teammates were also in attendance—here’s a few things that stood out to them: startups such as deep-tech Multiverse Computing, autonomous flight-focused Cloudline and AI-powered real-time translation tool creators Vosyn. They also attended talks of journalists, such as Financial Times’ tech reporter Hannah Murphy interviewing VC Annie Lamont. And they collected insights from Tech Crunch’s Editor-in-Chief Connie Loizos, and other investors from the world’s biggest funds, including Vinod Khosla of Khosla Ventures.

Annie Lamont, First Lady of Connecticut and health-tech VC, discussed the challenges of the venture capital market with Financial Times’ tech reporter Hannah Murphy. Annie spoke in detail about when a company is ready for VC. After a digestion period of tech, which is how she referred to the post-2021 market phase, there finally are margins and business models that make sense. Now could be a good exit market—and Annie still sees plenty of money out there.

By all accounts: the amount of VC investment flowing in the market today is significantly lower than in 2021. The Organisation for Economic Co-operation and Development (OECD) reports venture capital investments in the US reached $260 billion in 2021. VC investments dropped in 2022 to $188 billion, and then again in 2023 down to $129 billion—just half of what they were in 2021.

According to PitchBook reports, AI is the outlier here. Many VC investors are looking to invest in AI, and the field has some big names. In May 2024, Elon Musk's xAI raised $6 billion in Series B funding, while Mistral AI raised $640 million in June. And yet, even AI and machine learning investments have declined, albeit at a lesser rate. 2023 saw $90 billion raised, as opposed to the $102 billion invested in 2022.

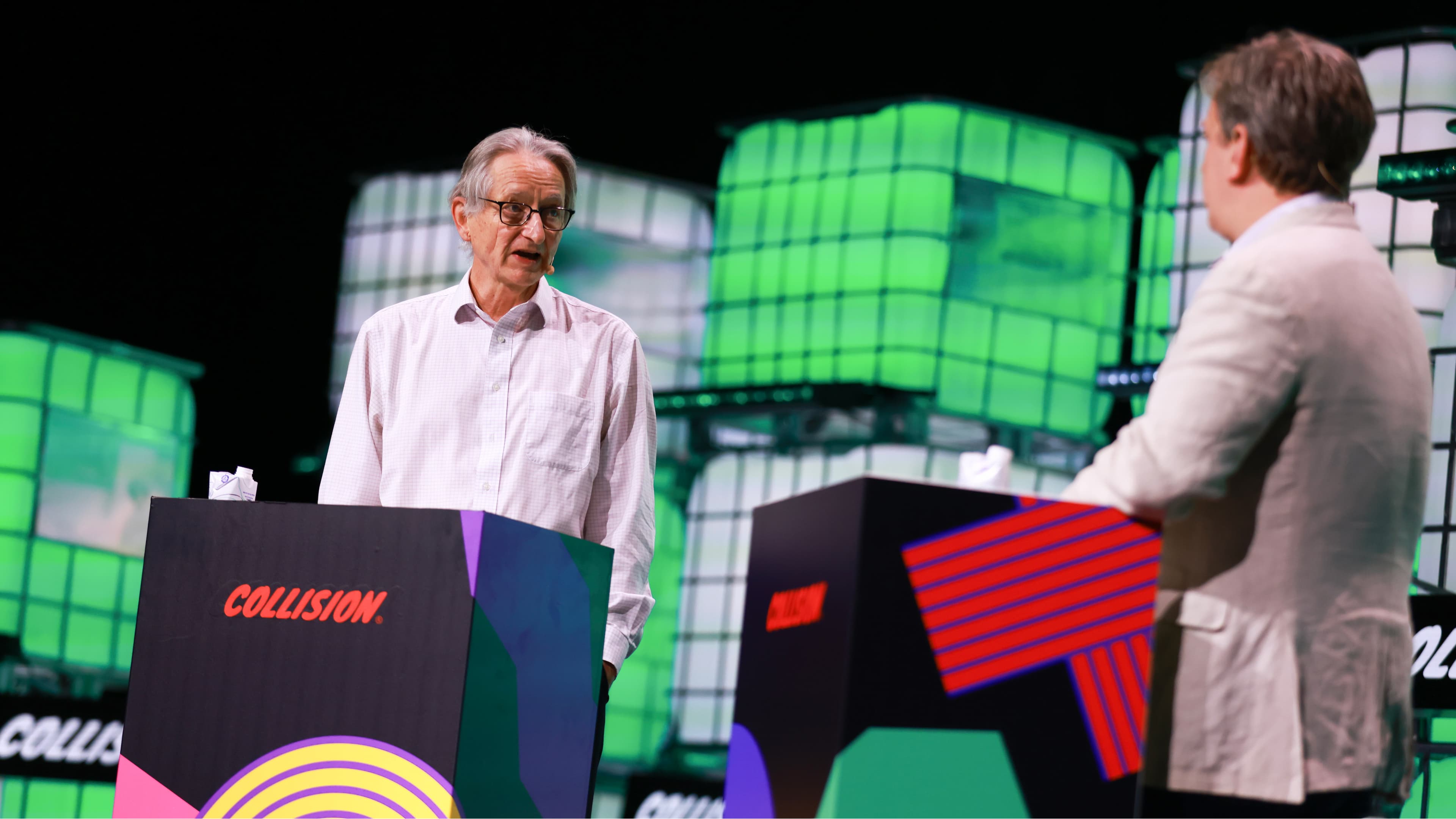

In counterpoint to the optimistic view of artificial intelligence, Geoffrey Hinton—one of the inventors of the neural network technology that drives machine learning and AI—examined potential dangers in his talk at Collision.

The so-called toxic cloud of anxiety around such topics as cybercrime and autonomous weaponry stood in the forefront of Geoffrey's talk—reminding attendees that AI laws and regulations often include loopholes for military applications of this technology. He emphasized surveillance as the most urgent concern, because AI will be very good at it.

Misinformation and deepfakes were other points that Geoffrey outlined to the Collision audience. The so-called ‘Godfather of AI’ proposed helping society build up resilience to such content by producing and distributing it now with disclaimers at the end.

Geoffrey Hinton on Centre Stage during day two of Collision 2024 at the Enercare Centre in Toronto, Canada. Photo by Vaughn Ridley/Collision via Sportsfile

Geoffrey (pictured left) finally discussed the existential threat AI could pose—one he underlined not as science fiction, but very real. His suggestion here is that “governments should be involved in forcing the big AI companies to do lots of safety experiments.” Because government is the only thing powerful enough to make big companies invest properly in AI safety.

However, it's possible to go too far in the other direction. Sun Microsystems co-founder, early backer of OpenAI and self-proclaimed techno optimist Vinod Khosla has spoken before about LLMs like OpenAI's needing to be safeguarded.

At Collision, Vinod talked at length about the importance of regulation and the dangers of overdoing it, explaining that antitrust is a good thing to have in any country and economic system, but over-enforcing or over-executing is bad economic policy. And the US has a more rational business evironment compared to that of Europe, which, he added, is why the Europeans have regulated themselves out of leading in any technology area. "They basically have regulated themselves out of AI, out of all social media, out of all internet startups," said Vinod.

Meanwhile, Vinod sees China as the largest AI risk because of their mindset that is at odds with the liberal values of the United States. A successful China would, according to the investor, be able to "export both the economic power that comes with AI and their political philosophy."

Vinod predicts AI will double GDP growth in the US from 2% to 4%, 5%, or even 6%, which he thinks will bring huge abundance to economies in the next 50 years. GDP growth in Europe right now is less than 1%.

Since 2019, Toronto has been the home of Collision. In that time, 97,651 people have attended the event. “Collision has been an incredible success story for Canada’s tech ecosystem,” said the Honourable Harjit S. Sajjan, Minister of Emergency Preparedness and Minister responsible for the Pacific Economic Development Agency of Canada (PacifiCan). Both Collision and the Toronto tech scene have grown together over the past five years, with the city now boasting some 24,000 companies, and 289,000 technology workers. The number of people working in tech-specific occupations has grown 25+ per cent since 2019, with the creation of 31,405 more tech talent jobs than graduates.

However, the Collision conference will be rebranded and move to Canada’s West Coast. In May 2025, the first ever Web Summit Vancouver will launch.

Photo credits: Piaras Ó Mídheach/Collision via Sportsfile; Vaughn Ridley/Collision via Sportsfile

Share

See all